What Is A Fha Home Loan

Fha loans are designed for low to.

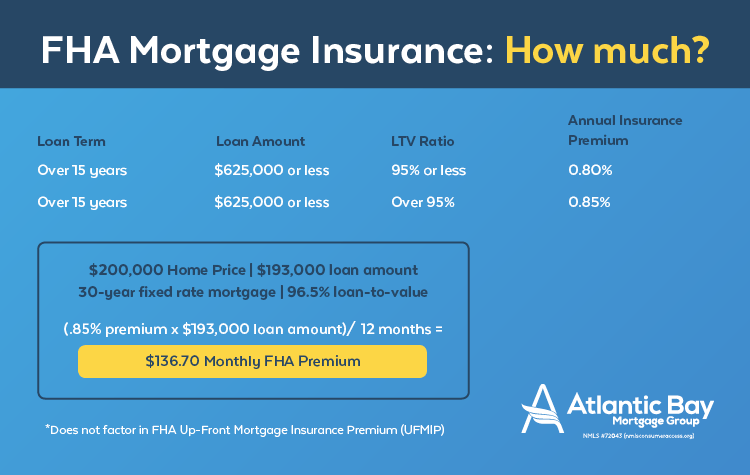

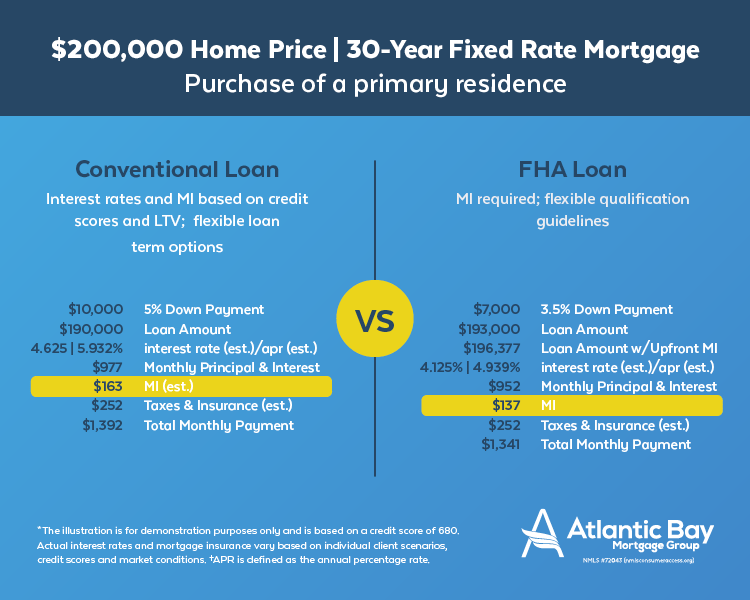

What is a fha home loan. Additionally the lender checks the financial history of the person getting the loan to see whether they have been delinquent on loans owed to the us. What is an fha loan. Fha home loans are perfect for first time home buyers who want to take advantage of the low down payment requirement and for those who have credit blemishes. However borrowers must pay mortgage insurance premiums which protects the lender if a borrower defaults.

It is a government loan which makes qualifying for an fha loan a lot easier than a conventional loan. If they are they do not qualify for a fha loan. Make sure you fit the right profile and that you understand the bad aspects of fha loans before you sign up for one. An fha loan is a mortgage issued by federally qualified lenders and insured by the federal housing administration fha.

Department of hud 2019 annual report. In 1934 the federal housing administration fha was established to improve housing standards and to provide an adequate home financing system with mortgage insurance. What is a fha loan. Home improvement and repairs.

Fha loans are popular because they make it relatively easy to buy a home. If youre buying a property that needs upgrades those programs make it easier to fund both your purchase and the improvements with just one loan. Now families that may have otherwise been excluded from the housing market could finally buy their dream home. Borrowers get their home loans from fha approved lenders rather than the fha which only insures the loans.

Fha loans are the 1 loan type in america with 1141 of all single family residential mortgage originations and 1 market share for first time home buyers at 8284. Fha loans are the 1 loan type in america with 1141 of all single family residential mortgage originations and 1 market share for first time home buyers at 8284. Fha approved lenders can have different rates and costs even for the same loan. They are popular especially among first time home buyers because they allow down payments of 35 for credit scores of 580.

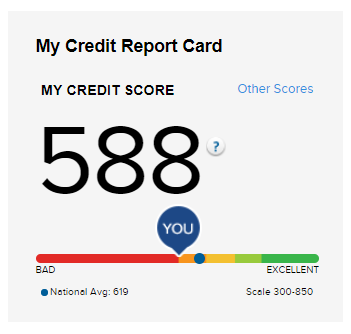

Certain fha loans can be used to pay for home improvement through fha 203k programs. Fha loans require a minimum fico score of 580 to qualify for 35 percent down or 500 for 10 percent down. An fha loan is a mortgage thats insured by the federal housing administration fha. Fha does not make home loans it insures a loan.