Home Equity Loan Example

Home equity loans are very similar in concept to traditional mortgages.

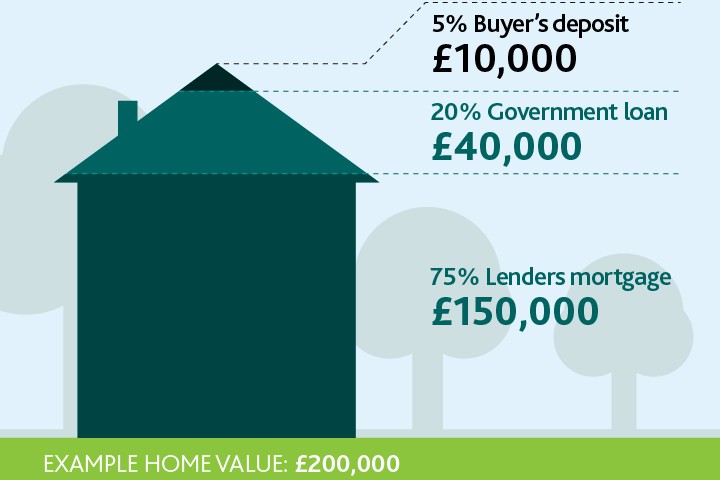

Home equity loan example. The easiest way to understand equity is to start with a homes current value and subtract the amount owed on any mortgages or other liens. Assume you purchased a house for 200000 made a 20 down payment and obtained a loan to cover the remaining. The home equity loan is the traditional second mortgage. The loan amount is determined by the value of the property and the value of the property is determined by an appraiser from the lending institution.

Now in 2020 you can get a. Home equity example. Home equity loans can be viable options when compared to credit cards or other high interest unsecured loans. You can claim a tax deduction for the interest you pay if you use the loan to buy build or substantially improve your home according to the irs.

Home equity loan example. For example home equity loans generally must be repaid over a fixed period. There are traditional and hybrid helocs. A loan in effect for a specific term usually but not always fixed rate.

Some lenders may offer fixed rates on these loans others might offer variable rates. For example home equity loans generally must be repaid over a fixed period. Some lenders may offer fixed rates on these loans others might offer variable rates. As a line of credit the borrower can use any amount up to the approved maximum.

Youll probably pay less interest than you would on a personal loan because a home equity loan is secured by your home. A home equity line of credit heloc is a loan using a house as collateral. What we like about home equity loans. G 24b periodic statement sample home equity plans page 1 of 2 xxx bank home equity line of credit account statement account number xxxx xxxx xxxx xxxx february 21 2012 to march 22 2012 summary of account activity previous balance 2510500 payments 000 other credits 000 variable rate advances 250000 fixed rate advances 500000 fees charged 6500 total interest charged.

Youre approved for x dollars the lender gives you the check and you get a repayment schedule. If a homeowner purchases a home for 100000 with a 20 down payment and covers the remaining 80000 with a mortgage the owner has equity of 20000 in the house. Those mortgages might be purchase loans used to buy the house or second mortgages that were taken out later. Lets say that 10 years ago when you first purchased your home interest rates were 5 on your 30 year fixed rate mortgage.

/GettyImages-511327652-5bf0578946e0fb0051ac6acc.jpg)