Home Refinance Rates Today

Still we want to be sure your rate questions get answered so this section is packed with useful rate info with the exception of why the percentage sign looks so funny.

Home refinance rates today. Find and compare todays mortgage refinance rates in your area. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Compare current customized mortgage refinance rates from our top rated lenders. Get the latest information on current 20 year fixed refinance rates.

Lendingtree will allow you to comparison shop different interest rates and aprs helping to save you the most money possible on your. Compare mortgage rates from multiple lenders in one place. No one knows that. Todays 15 year refinance rates the table below brings together a comprehensive national survey of mortgage lenders to help you know what are the most competitive 15 year refinance interest rates.

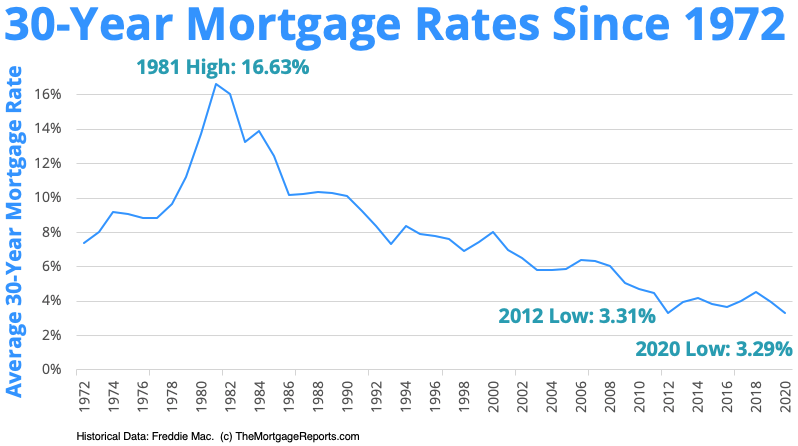

The current mortgage rates listed below assume a few basic things about you including you have very good credit a fico credit score of 740 and youre buying a single family home as your primary residencecheck out the mortgage rates charts below to find 30 year and 15 year mortgage rates for each of the different mortgage loans us. Its fast free and anonymous. Refinance rates valid as of 14 may 2020 0847 am cdt and assume borrower has excellent credit including a credit score of 740 or higher. We want to find you the best rate possible.

The average 15 year fixed refinance rate is 2970 with an apr of 3150. Its just that finding the best refinancing option for you involves more than just chasing a rock bottom rate. Get the latest information on current 20 year fixed refinance rates. Compare 20 year refinance rates from lenders in your area.

The 51 adjustable rate refinance arm rate is 3350 with an apr of 3910. Keep in mind fixed rate only refers to the rates but there are many types of fixed rate mortgages such as 15 year fixed rate jumbo fixed rate and 30 year fixed rate mortgages. To start simply enter in your type of loan your homes current value your current mortgage balance your home type and your credit score. Arm interest rates and payments are subject to increase after the initial fixed rate period 5 years for a 51 arm 7 years for a 71 arm and.