Refinance Home Loan

Try our easy to use refinance calculator and see if you could save by refinancing.

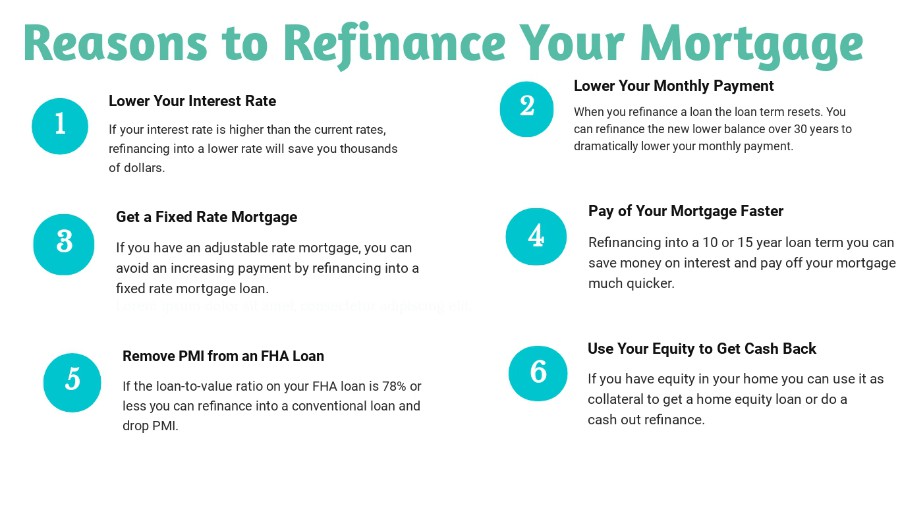

Refinance home loan. Compare home loan options. See how home loan mortgages differ. People refinance to save money tap the homes equity or trade an arm for a fixed rate loan. Different loans meet different needs.

A mortgage refinance replaces your home loan with a new one. So can your cash flow or your homes value. Interest rates can change. Refinancing your home loan can save you more money with less hassle than any other cost cutting decision.

The lender must deliver this document within three business days of receiving your mortgage application. Make sure its a loan type that matches your situation. Borrowers might notice slightly higher refinance rates when theyre in demand. While you can extend repayment to increase the term of the loan but potentially pay more in interest costs you also can refinance into a shorter term loan.

From streamlined packages to fully featured loans you will find the low rate home loan to suit your needs. Compare refinance home loans at canstar to see if you could be saving. Does your home loan start with a 2. The law requires lenders to give you a loan estimate which is their best estimate of what your loan might cost if the financial details in your loan application are verified and match what you provided.

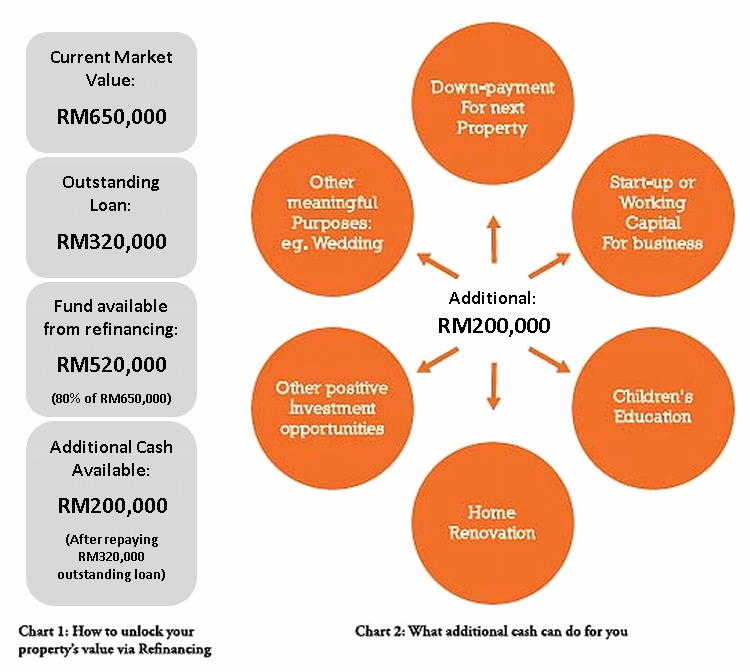

Your situation may help you decide between home equity financing or a mortgage refinance. If you do decide to switch lenders look for a loan with a better rate and features you need. Estimate your new monthly mortgage payment savings and breakeven point. Compare australian refinancing home loan deals whether you want to save money on your mortgage pay off your loan sooner get cash out from your property or consolidate debt refinancing your home loan may be able to help.

Refinance and purchase loans typically have the same rate.